UK company accounts, UK mtd vat return UK tax return and best UK accountant

Actions

ACCA member and practice manager (UK Accountant) in UK-based tax consultancy firm. I have a portfolio of 200+ companies and more than 100 + sole traders.

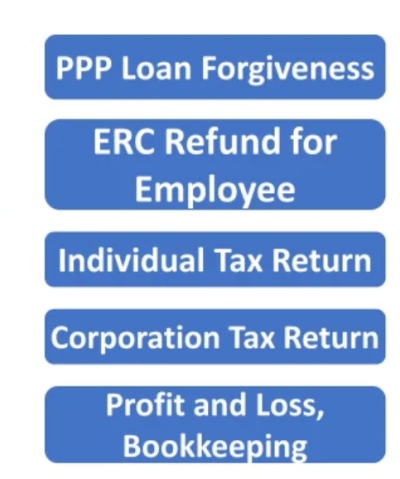

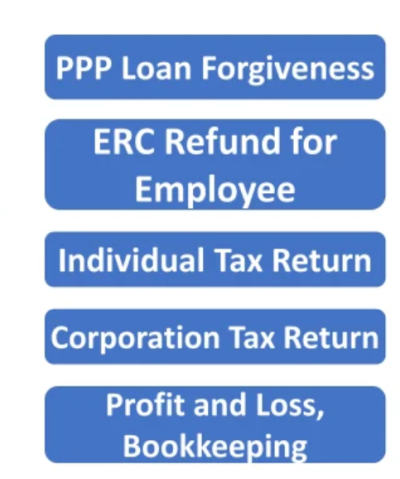

My core tasks are:

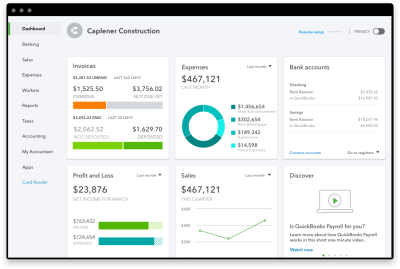

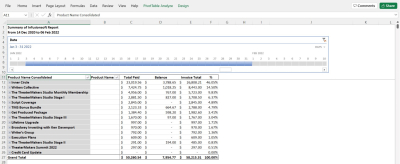

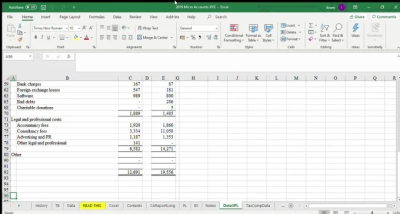

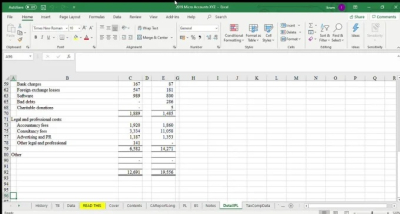

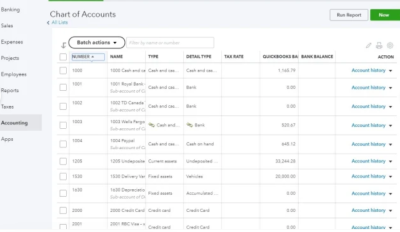

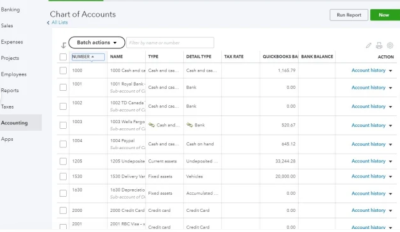

Book-keeping on Xero, Quickbooks and VT Sage-50. And Profit keeper profits book from Xero: quickbooks for Vt, sagge-50 or Profit keeper.

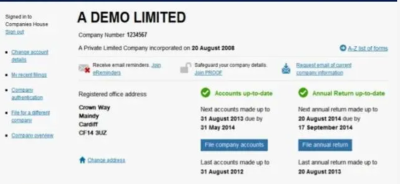

England and Wales. Submission of annual account to companies' house (England and Wales).

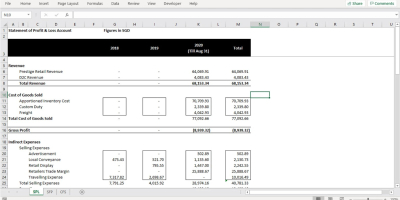

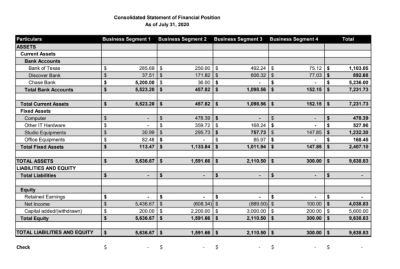

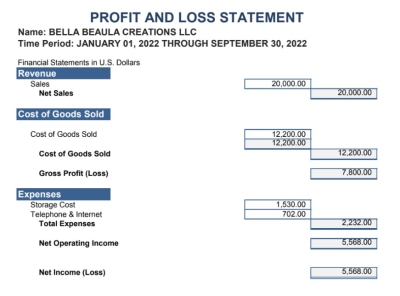

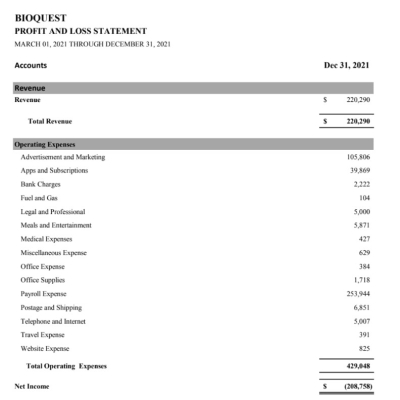

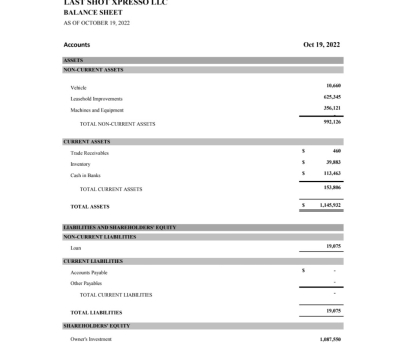

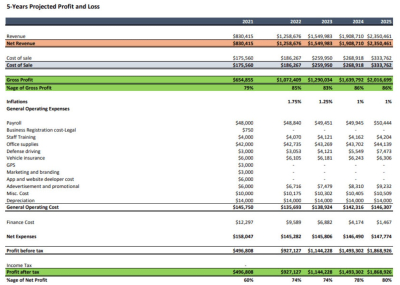

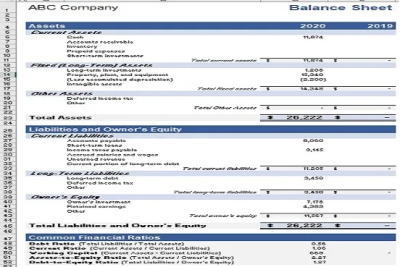

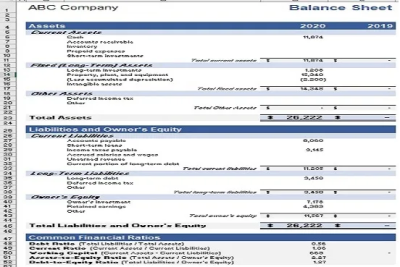

I will create financial statements for all type of business, such as sole trading companies and partners.

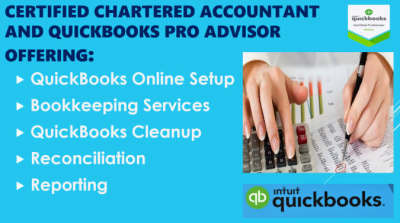

The preparation of management accounts (Monthly and quarterly) to evaluate the business performance is required.

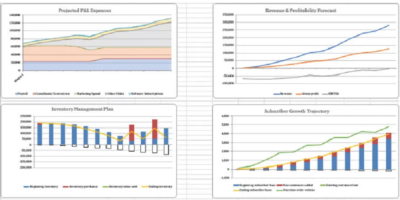

The corporation tax calculation and returns (CT600) submission to HMRC for the company's tax calculation and returns (CT600) is required.

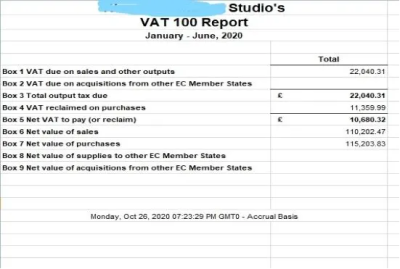

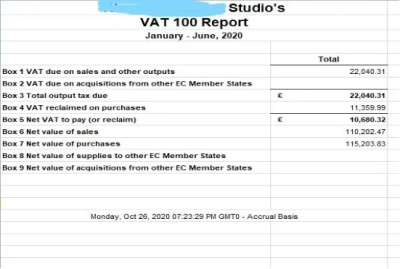

VAT returns preparation and HMRC submitting to HMRC. The process of preparing VAT returns, as.

Employee personal tax returns.

Internet filing of tax returns for companies and LLP to HMRC (UK) is possible.

And if you need these services, just call me! • You will get professional services and a fast turnaround

How would you ensure my information security?

This is my core business ethic so my customer feels the information are just about as protected as without help from anyone else. Being a member of ACCA I'm complying with the new General Data Protection Regulation, which came into effect on 25 May 2018.

How does the Xero accounting measure work with you?

You will need to give me your Xero account access, for this, you will need to perform the following steps: 1) Login into Xero accounts 2) Open settings menu 3) Then click on the users option 4) Add new users 5) Enter my first and last name with the email address

For what reason would it be beneficial for me to pick you over your rivals?

I'm working in UK based accountancy practice firm from last 6 years, I can provide you all the services which include: Accounts preparation and submission VAT preparation and submission. Bookkeeping Dealing with companies house and HMRC inquires Monthly payroll and CIS calculation

Are you available to become my accountant for longer term

Definitely, I'm happier to become your permanent accountant and establish good relation with you.

Once again seller delivered a medium quality. I’m not highly impressed with their attention to details

Seller is easy to work with. Satisfied customer!

I will definitely recommend you a 90% and will be using your services.

Freelancer did not do as I asked but did it in a timely manner! will def be back! LOL

Very fast delivery, honest and great service! Will use again, thank you

Not easy but extremely fast.. I am very satisfied with the work and would highly recommend this seller.

I definitely recommend this seller! However, keep going with deadliens!

Talented, creative, thoughtful . Super happy with what you did.

The seller accepted the order right away, but could not complete on time.

You may also like the following gigs