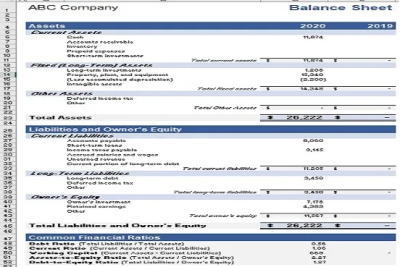

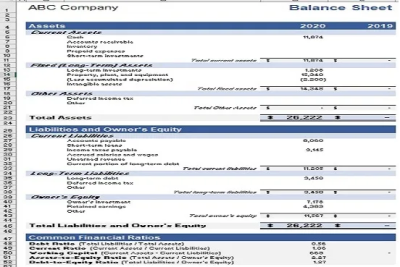

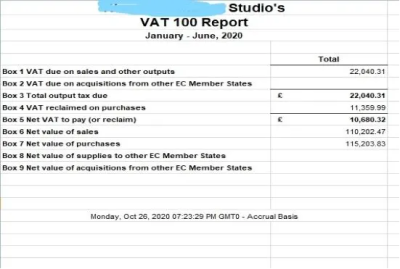

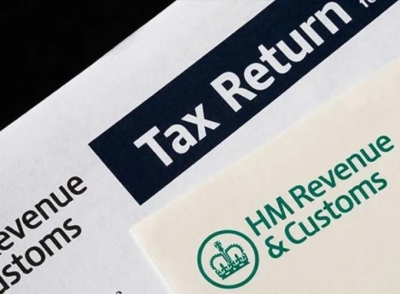

I can submit the UK company's financial statements, VAT declaration and self-assessment to hmrc

Actions

Confused about HMRC corporate tax returns and company house compliance or worried about deadlines?

I am a Chartered Accountant and an experienced tax accountant, providing all types of accounting and tax services such as tax returns, annual accounts and self-assessments.

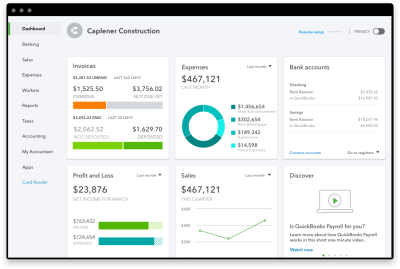

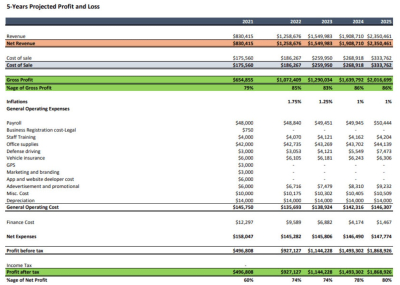

Here is my service:

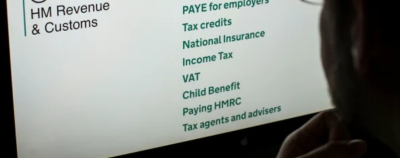

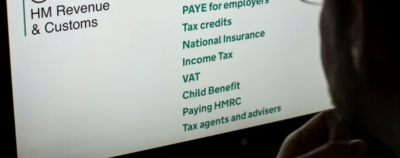

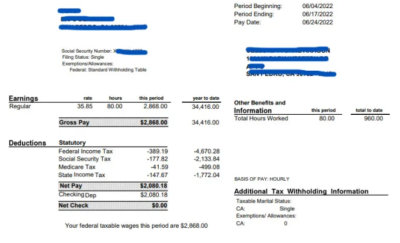

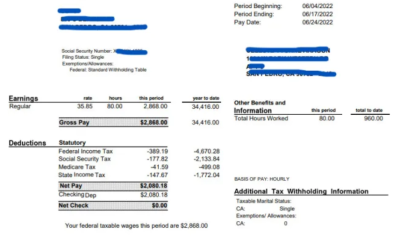

1- Filing a UK based Corporate Tax Return (CT-600) with HMRC,

2- Submit your personal tax return (Self Assessment Tax SA-100) to HMRC.

3- Submit the company's annual accounts to the company's house.

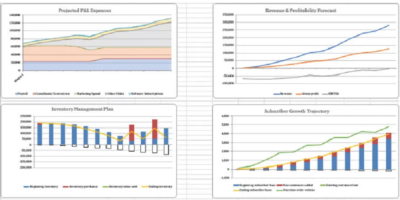

4- Preparation of UK only accounts and corporate tax returns.

5- Register the business for his VAT.

6- De-register her VAT registration of the business.

7- Submission of VAT return to HMRC.

8- UK Limited Company Registration.

9- UK Limited Company Deregistration/Strike Off (Form DS01).

10- Tax Advisory and Consulting.

Why Choose Me:

1- I am a professional and will complete assignments if I am facing a deadline.

2- 100% satisfaction guaranteed.

What is the process?

Its simple i will get the relevant information such as Company UTR, Company Authentication code etc and start off with the process. If you will have done the whole year bookkeeping, its good otherwise i will do it and then prepare the draft, send you for approval and finally submit to HMRC.

How can you ensure confidentiality?

I am a Professional Chartered Accountant and Tax Practitioner, it is one of my core ethical principle to keep the client's information confidential. So, rest assured that your information is in safe hands. You can also sign a privacy & confidentiality agreement if it suits you.

Are you available on long term basis?

Yes, Always believe in long term relationship with clients.

I’ll be happy to work with them again. nice seller!

I really appreciate the thoughtfulness and dedication to my project, I'll definitely be a repeat customer!

I would love to work with you again but no. !

we have been working with them since very long and they always stands out to our expectations

The professional worked on time and understood the main objective of the topic

I enjoyed this process and working with the freelancer. I think they are excellent at their craft, but the turnaround was not great.

Whatever, not the ideal choice for me. Sorry.

This performer just lost! I made an order that needed to be completed within a day! This performer just let me down:((

You have a great intuition for what a client needs -but could not implement them.

You may also like the following gigs