I am engaged in the accounts of British companies and filing tax returns in the UK

Actions

Struggling with UK tax compliance, tax notices or company notices? If yes, changes in laws and regulations make sense.

Prepare the following items and submit them to HMRC and the company hall.

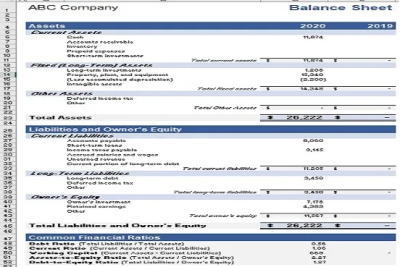

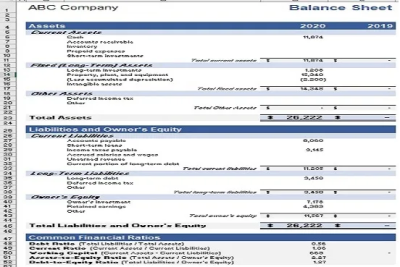

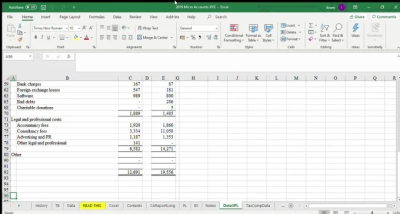

1. Financial Statements / UK Company Accounts

2. Company UK Tax Return (UK Corporation Tax Return CT600, UK Tax Return or UK Tax Return) UK Tax Return (HMRC)

3. Quarterly UK VAT Return (HMRC)

Service:

We provide the following services:

- Filing a UK tax return (Corporate tax return CT600, Self-assessment tax return)

- Submission of UK company accounts

- Quarterly UK VAT return submissions

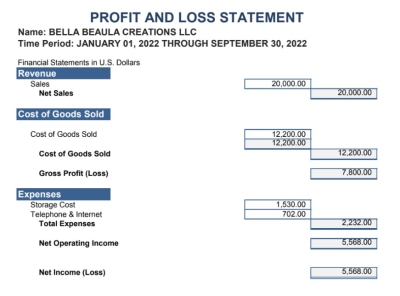

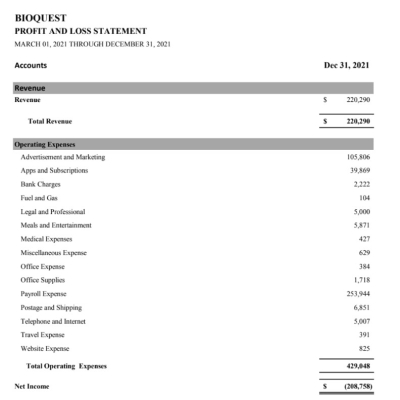

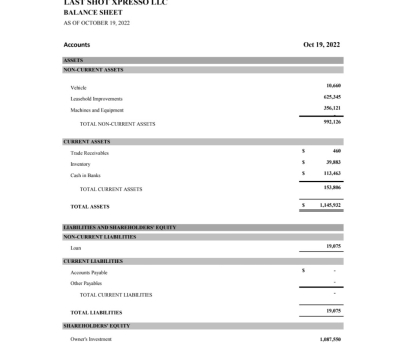

- Preparation of financial statements / UK company accounts

We can provide services for bookkeeping, preparation of annual accounts, corporate tax returns, self-assessed tax returns and filings with companies and HMRC.

Why choose me?

I have over 6 years of experience as an accountant and tax consultant, working with UK and US based individuals and companies.

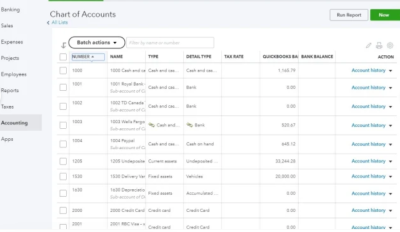

I am proficient with all major accounting software such as Quickbooks, Zoho, Wave, Xero and Tally.

Do you have experience of dealing with HMRC?

Yes I do have experience in dealing with HMRC.

Can you prepare U.K Corporation Tax (CT600) return?

Yes, I can prepare and file U.K Corporation Tax Return as well as Personal Income Tax Return (Self Assessment Tax Returns) to HMRC.

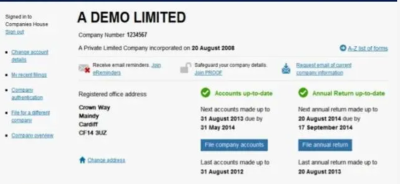

Can you prepare and file my U.K annual accounts to Companies House?

Yes, I can prepare and file your annual accounts to Companies House.

WHAT a NICE person to work with, totally recommend their services.

Seller is really good. I would recommend them and also take for my next projects.

It was lovely experience with this freelancer✌ Recommended but needs edits.

Many edits. I don't like many edits. I need the work to be done without revision.

Awesome work and quick delivery. Thanka alot!

I am completely satisfied and I am happy to find them and will be back for more

We worked well together and I am a returner buyer!

Seller was very responsive. Order was delivered on time. Thank you!

I am almost blown away by the service. I look forward to testing the effectiveness.

Almost understood our business and did a great job, Looking forward to do more work together.

You may also like the following gigs